Mutual of Omaha life insurance rate charts provide detailed pricing information, helping individuals understand policy costs and coverage options․ These charts are essential for comparing rates․

Overview of Mutual of Omaha Life Insurance

Mutual of Omaha offers a range of life insurance policies, including term, whole, and universal life insurance․ Known for financial stability, they provide coverage options tailored to individual needs․ Their policies aim to secure futures, offering flexibility and affordability․ With a strong reputation, Mutual of Omaha is a trusted choice for life insurance, ensuring protection for loved ones․ Their rate charts simplify cost comparisons, helping applicants make informed decisions based on age, health, and coverage preferences․

Importance of Rate Charts in Life Insurance Planning

Life insurance rate charts are crucial for planning, offering transparency into premium costs based on age, health, and coverage options․ They enable individuals to compare policies and budgets effectively․ By reviewing Mutual of Omaha’s rate charts, applicants can understand how rates increase with age and identify the best coverage for their needs․ These charts also highlight potential savings opportunities, ensuring informed decisions aligned with financial goals and personal circumstances․

Understanding the Mutual of Omaha Life Insurance Rate Chart PDF

The Mutual of Omaha Life Insurance Rate Chart PDF provides detailed rate information, coverage options, and pricing structures, helping users make informed decisions about their life insurance needs․

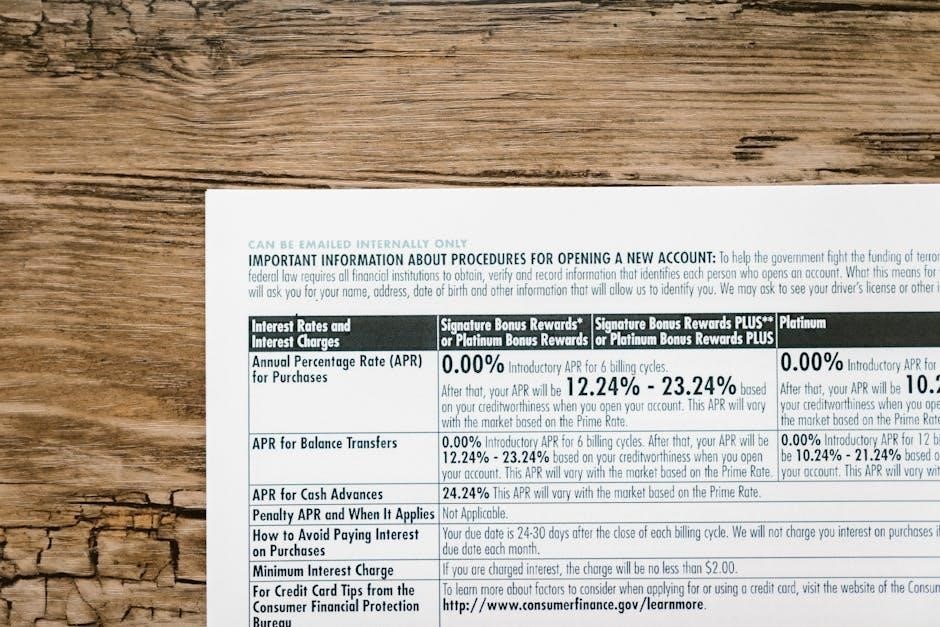

Structure and Content of the Rate Chart

The Mutual of Omaha life insurance rate chart is organized to provide clear and concise information about policy costs․ It typically includes premium rates, coverage options, and policy terms․ The chart is structured by age groups, policy types, and coverage amounts, making it easy to compare rates․ Additional details such as tobacco usage and health classifications are often included to reflect accurate pricing․ This structured format helps users quickly identify the best options for their needs and budget, ensuring informed decision-making․

How to Read and Interpret the Rate Chart

The Mutual of Omaha life insurance rate chart is designed for easy interpretation․ Start by locating your age group and policy type (term or permanent)․ Identify the coverage amount and term length to find the corresponding premium rate․ Rates are typically displayed per $1,000 of coverage․ Tobacco use and health classifications (e․g․, Preferred Plus or Standard) also affect pricing․ Compare rates across policy terms to determine the best fit for your needs․ For accuracy, consult a licensed agent to ensure the rates align with your personal profile and preferences․

Types of Life Insurance Policies Offered by Mutual of Omaha

Mutual of Omaha offers term, whole, and universal life insurance policies․ Term life provides coverage for a specific period, while whole and universal offer lifelong protection with cash value growth․

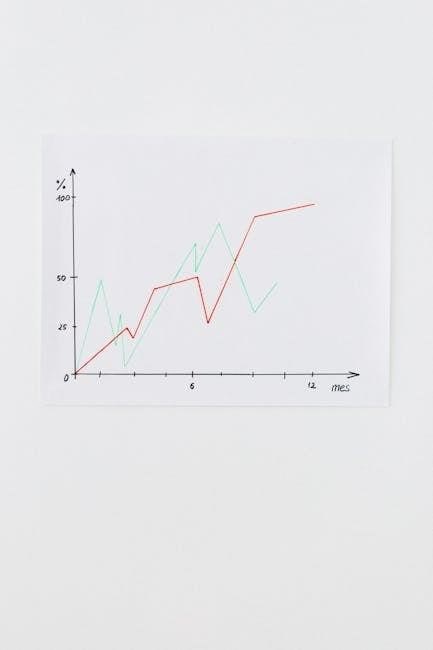

Term Life Insurance Rates

Mutual of Omaha’s term life insurance rates vary based on factors like age, health, and coverage amount․ For example, a 20-year, $250,000 policy for a healthy 30-year-old female averages $155 annually․ These rates are competitive and provide temporary coverage for specific needs, such as mortgage payments or family support․ The rate charts offer transparent pricing, allowing policyholders to budget effectively․ Rates increase with age, emphasizing the importance of early enrollment for cost savings․ Customizable term lengths and coverage options ensure flexibility for diverse financial situations and goals․

Whole Life Insurance Rates

Mutual of Omaha’s whole life insurance rates offer predictable, level premiums and guaranteed cash value growth․ Policies are designed for lifelong coverage, with rates determined by age, health, and coverage amount․ For instance, a $100,000 policy for a healthy 40-year-old might cost around $250 monthly․ The rate charts outline these costs clearly, ensuring transparency․ Whole life insurance provides permanent protection and builds cash value over time, making it a popular choice for long-term financial planning and estate preparation․ Mutual of Omaha’s strong financial ratings reinforce the reliability of these policies․

Universal Life Insurance Rates

Mutual of Omaha’s universal life insurance rates offer flexibility in premiums and death benefits, tailored to individual needs․ These policies combine lifelong coverage with a cash value component that grows over time․ Rates vary based on factors like age, health, and coverage amount, with potential for adjustments in premiums․ The rate charts provide a clear breakdown of costs, ensuring transparency․ Universal life insurance is ideal for those seeking adaptable coverage and cash accumulation opportunities, backed by Mutual of Omaha’s financial stability and strong industry ratings․

Factors Influencing Mutual of Omaha Life Insurance Rates

Factors influencing Mutual of Omaha life insurance rates include age, gender, health, lifestyle, policy term, and coverage amount․ These elements determine premium costs and policy eligibility․

Age and Gender Factors

Age and gender significantly impact Mutual of Omaha life insurance rates․ Premiums typically increase with age due to higher mortality risks․ Gender also plays a role, as life expectancy statistics differ between males and females․ Younger applicants generally qualify for lower rates, while older individuals may face higher costs․ Mutual of Omaha’s rate charts provide detailed breakdowns, allowing policyholders to understand how these factors influence their premiums․ Consulting the official rate chart PDF ensures accurate, personalized pricing information based on these demographic factors․

Health and Lifestyle Factors

Health and lifestyle factors significantly influence Mutual of Omaha life insurance rates․ Individuals with pre-existing medical conditions or poor health histories may face higher premiums․ Lifestyle choices, such as smoking or risky hobbies, also impact pricing․ Mutual of Omaha’s underwriting process assesses these risks to determine policy costs․ The rate chart PDF provides insights into how health and lifestyle factors affect premiums, helping applicants understand potential costs․ Consulting the chart ensures a clearer understanding of how personal health and lifestyle impact life insurance rates․

Policy Term and Coverage Amount

Policy term and coverage amount are crucial factors influencing Mutual of Omaha life insurance rates․ Longer policy terms or higher coverage amounts typically result in increased premiums․ The rate chart PDF provides a clear breakdown of how these elements impact costs, allowing customers to compare rates for various term lengths and coverage levels․ Understanding these dynamics helps policyholders choose a plan that aligns with their financial goals and provides adequate protection for their loved ones․

Sample Mutual of Omaha Life Insurance Rates

Mutual of Omaha provides sample life insurance rates, offering insights into policy costs for various coverage levels and terms, as detailed in their rate chart PDF․

Rates for Term Life Insurance Policies

Mutual of Omaha offers competitive term life insurance rates, with policies ranging from 10 to 30 years․ For example, a healthy 30-year-old female might pay $155 annually for a 20-year, $250,000 policy․ Rates vary based on age, health, and coverage amount․ The Term Life Answers product provides straightforward pricing, with premiums increasing as the policy term extends․ Detailed rate charts are available in PDF format, offering transparency for potential policyholders to compare options and select the best fit for their financial needs and preferences․

Rates for Permanent Life Insurance Policies

Mutual of Omaha’s permanent life insurance policies, including whole and universal life insurance, offer lifelong coverage with guaranteed rates․ Whole life insurance rates start around $2,100 annually for a $500,000 policy for a healthy 35-year-old male․ Universal life insurance rates are flexible but typically higher․ Factors like age, gender, and health significantly influence premiums․ The PDF rate charts provide detailed breakdowns of coverage options and premiums, ensuring transparency for policyholders seeking permanent protection and cash value growth opportunities․

How to Apply for Mutual of Omaha Life Insurance

Applying for Mutual of Omaha life insurance involves selecting a policy, providing personal and medical information, and completing the underwriting process․ Their plans are highly rated․

Application Process Overview

The application process for Mutual of Omaha life insurance begins with selecting a policy that fits your needs․ You’ll need to provide personal and health information, which may include a medical exam․ Once submitted, your application is reviewed by underwriters who assess your eligibility and determine your premium rate․ Approval typically follows, after which you’ll receive your policy․ Mutual of Omaha is known for its streamlined process and competitive rates, making it a popular choice for life insurance coverage․

Required Documentation and Medical Exams

Applying for Mutual of Omaha life insurance typically requires personal identification, medical history, and lifestyle details․ A medical exam may be necessary, involving blood and urine tests․ This helps underwriters assess health risks and determine premiums․ Additional documentation, such as prior medical records, may be requested․ The process ensures accurate policy pricing, reflecting individual circumstances and coverage needs․ Timely submission of required documents expedites the approval process․

Comparing Mutual of Omaha with Other Life Insurance Providers

Mutual of Omaha offers competitive rates and flexible policies, often rivalling top providers․ Their term and permanent life insurance options are tailored to diverse needs, ensuring affordability and coverage․

Rate Comparison with Leading Competitors

Mutual of Omaha’s life insurance rates are competitive with leading providers like Globe Life and United of Omaha․ Their term life policies often offer lower premiums for healthy individuals, while permanent life insurance rates remain stable․ The company’s customizable coverage options and flexible term lengths make it a strong contender in the market․ By comparing Mutual of Omaha’s rate charts with others, clients can identify the best fit for their budget and coverage needs, ensuring a cost-effective solution for their life insurance requirements․

Unique Features of Mutual of Omaha Policies

Mutual of Omaha offers flexible life insurance options, including whole, term, and universal life policies․ Their term life insurance provides coverage for specific periods, while whole life offers lifelong protection with cash value growth․ The company also offers living benefits, allowing policyholders to access funds for chronic or terminal illnesses․ With strong financial ratings, including an A+ Superior rating from A․M․ Best, Mutual of Omaha ensures reliability․ Their policies often include flexible term lengths and coverage amounts, catering to diverse needs․ Additionally, some policies allow for coverage without medical exams, making them accessible to a broader range of applicants․

Mutual of Omaha life insurance rate charts offer clear, detailed pricing, helping policyholders make informed decisions․ Their policies provide reliable coverage options tailored to individual needs and financial goals․

Final Thoughts on Mutual of Omaha Life Insurance

Mutual of Omaha offers a range of life insurance options with transparent pricing, making it a reliable choice for securing financial futures․ Their rate charts provide clear insights, enabling informed decisions․ With strong ratings and flexible policies, Mutual of Omaha caters to diverse needs, ensuring coverage tailored to individual circumstances․ Their commitment to customer satisfaction and comprehensive coverage options solidify their reputation as a trusted provider in the life insurance market․

Next Steps for Potential Policyholders

After reviewing the Mutual of Omaha life insurance rate chart PDF, potential policyholders should assess their coverage needs and budget․ Comparing rates across policy types, such as term or whole life insurance, can help identify the best fit․ Consulting with a licensed agent or financial advisor is recommended to address specific questions․ Applicants can then proceed to the application process, ensuring all required documentation is prepared․ Finally, reviewing and understanding the policy terms before signing is crucial to make an informed decision․